on August 29, 2016 / by Downtown Dallas Inc. / in Blog Posts, Economic Development and Planning

Introduction

The Dallas Entrepreneur Center (DEC), is a nonprofit corporation that helps entrepreneurs start and grow their businesses. The DEC offers coworking space, organizes and accommodates numerous startup community events and hosts accelerator and training programs.

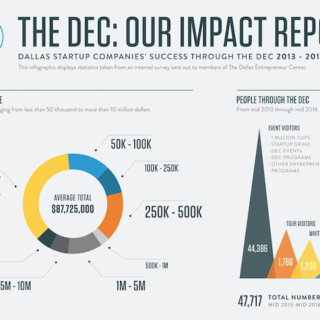

In 2015, the DEC surveyed existing tenants and graduates to measure revenue and employment growth and funding raised. The data was updated in 2016. The DEC made this data available to Axianomics to assess the overall economic impact of the DEC and its client firms.

Our analysis included 66 firms in the survey that provided the minimum necessary data. These results do not extrapolate beyond those firms to the larger population of DEC tenants and graduates. We have discussed the survey methods with the DEC and take the data at face value as being adequate to support the results presented below.

Results

The companies in the sample contribute over $130,000,000 to the economic output of the Dallas-Fort Worth-Arlington Metropolitan area (DFW MSA). This includes their direct operations and the indirect impact they have on other local firms. This is an annual estimate based on their most recently reported revenue and employment. In the same period, gross regional product (GRP) for the DFW MSA was $424,000,000,000 ($424 billion). These firms accounted for about three hundredths of a percent of total GRP.

This activity supports over 1,350 full-time equivalent jobs in the DFW MSA. This includes employment at the surveyed firms (direct employment) and jobs created at other local businesses to support those companies (indirect employment). While a tiny fraction of total local economic activity, a single firm with this employment level would be among the 200 largest companies in DFW according to Census Bureau County Business Patterns data.

Based on the locations of the firms represented, most of this activity is likely concentrated in Downtown Dallas and north along the Central Expressway, LBJ and Dallas North Tollway corridors in northern Dallas county.

Interpretation and Meaning

The bottom-line interpretation is that companies representing a sizable amount of economic activity chose to spend at least part of their critical startup period in the DEC and to participate in its programming. Further, these companies were willing to participate in a follow-up survey and share sensitive information about their operations with the DEC. This is a good indicator of their attitudes toward the DEC as an organization.

It is possible that their DEC experience was a significant contributor to the growth and activities of these firms. Unfortunately, we cannot demonstrate that impact with the current survey data.

At a minimum, the continued participation by startup companies at the DEC demonstrates that these entrepreneurs believe it is worth their funds and their time. Combined with testimonial information from tenants and graduates, this information could make a strong case for the importance of the DEC to the DFW economy.

Methods

Economic impact analysis measures the “spin-off” activity from an initial business project. Money spent by a local company is income to other local companies. The initial activity supports additional business and employment beyond itself through these transactions.

This spin-off effect can be measured by economic multipliers. These multipliers are based on administrative data collected by the U.S. Department of Commerce from millions of companies in the U.S. and they trace where funding moves among over 1,200 defined industries.

We calculated the impact of these firms with multipliers created by the U.S. Bureau of Economic Analysis, Regional Products Division. These multipliers are referred to as RIMS II (Regional Impact Modeling System II). The multipliers represent the entire DFW MSA for the 2013 calendar year. There are numerous assumptions with these multipliers found in the RIMS II User Guide:

http://bea.gov/regional/pdf/rims/RIMSII_User_Guide.pdf.

We applied a five-step process to calculate these impacts. We:

1. Assigned a North American Industrial Classification System (NAICS) industry code to all survey companies

2. Calculated total sales for each company using their reported revenue

3. Calculated the full-time equivalent (FTE) employment of each firm by converting part-time employees into FTE employees based on reported salaries

4. Applied Type I value-added and employment multipliers from RIMS II to the output and employment values from steps 2 and 3

5. Summed firm sales and employment with the multiplier generated results to create total (direct and indirect) value-added (output) and employment

About Axianomics, LLC

Axianomics, LLC is a public finance and economic development firm in Dallas, Texas. We help local leaders nurture their economies through discovery, strategy and implementation. Learn more at: www.axianomics.com.

tags: See More Posts